Worldwide, middle market M&A transactions, those with transaction values less than US$1 billion, have been occurring at a rapid pace in the first month of Q4. Middle market M&A in the United States, in particular, is seeing tremendous activity whereas M&A in Europe is continuing to struggle.

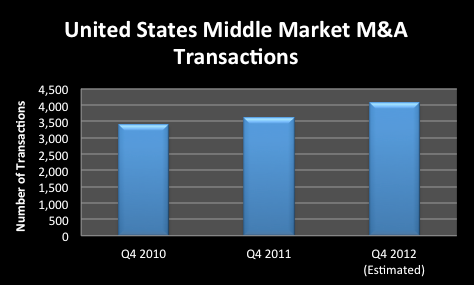

In the US, at this pace, we expect over 4,000 transactions in Q4. This will represent an increase of over 11% as compared to the 3,604 transactions in Q4 of last year. This growth can be explained by a number of factors, but most importantly, corporations are using some of their large cash balances and the ability to issue low interest debt to pursue synergistic and other acquisitions.

Traditionally, companies use their excess cash for either capital expenditures or acquisitions. According to a recent study published by Goldman Sachs, capital expenditures are not increasing as companies are deploying their cash for acquisitions, which provide immediate access to growth and less risk. This is, perhaps, the largest single driver in the current middle market M&A boom in the US. Furthermore, low interest rates are enabling companies to issue debt quite cheaply thereby helping companies without enough cash to fund acquisitions.

In Europe, the M&A landscape is facing challenges due to various factors such as economic uncertainty, political instability, and regulatory changes. These uncertainties are causing hesitation among companies to engage in M&A activities, leading to a slower pace of transactions compared to the US market.

Despite the struggles in Europe, the Middle East and Asia are also experiencing an increase in middle market M&A transactions. The Middle East, in particular, is seeing a surge in activity driven by the region's efforts to diversify its economy and attract foreign investments. Asia, on the other hand, is benefiting from a strong economic growth trajectory and an increasing appetite for cross-border acquisitions.

Overall, the global middle market M&A landscape is dynamic and evolving, with different regions experiencing varying levels of activity. Companies are strategically leveraging their resources and taking advantage of favorable market conditions to pursue growth opportunities through M&A transactions.

Versailles Group is a Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.