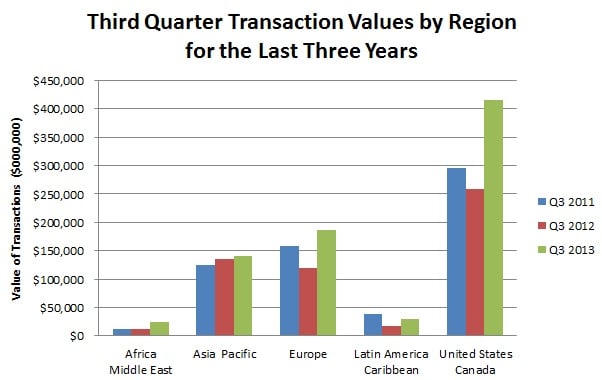

In the third quarter, M&A activity in the US and Canada increased dramatically, exceeding both 2012 and 2011 activity levels. Europe has also seen a resurgence of M&A activity despite some very difficult economic conditions. M&A activity is also up in Asia / Pacific, Africa / Middle East and in Latin America; however, Latin America hasn’t seen as much of an increase as the other geographies.

The question that this raises is why is M&A activity increasing? There are many reasons for this, including strong fundamentals, e.g., cheap and available capital, but also the simple fact that companies find M&A to be a very attractive way to build or defend shareholder value. Clearly, it’s faster and more advantageous for a company to acquire another business, people, products, equipment, customers, etc. than to build it from scratch. That’s an opportunity for both buyer and seller.

The fourth quarter is an excellent time to begin exploring the acquisition or divestiture of a business to build or protect shareholder wealth in the coming year. I founded Versailles Group almost 27 years ago as I’m passionate about helping management and/or owners grow or divest their businesses to enhance shareholder wealth.