Valuation Multiples and Selling your Business

Valuation Multiples and Selling your Business

Valuation multiples can serve as a starting point for estimating the value of your company. The valuation process, when utilizing multiples, is simple: by multiplying a financial metric such as EBITDA by an appropriate multiple, you arrive at a rough estimate for the enterprise value of your company.

So, you ask yourself, I know my company’s EBITDA, but how do I assign the correct multiple so that I calculate a fair enterprise value? The rote calculation of EBITDA*multiple is simple; however, assigning the “right” multiple is an art.

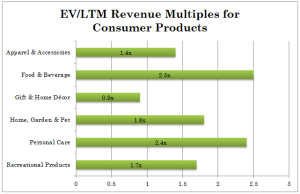

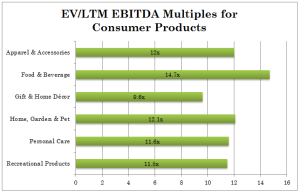

Generally, certain industries have a typical range of multiples for companies that exist in that space. A simple Google search will present websites that claim to provide “valuation multiples by industry.” But if you want to hone in on a more accurate multiple, you are encouraged to do more in-depth research. Organize a list of publicly traded companies that have a similar financial and business make-up to the company you wish to value (i.e., they operate in the same industry and have other similarities). Next, compile a range of trading multiples for these companies by dividing their enterprise value (“EV”) by a financial metric like EBITDA (EV/EBITDA, EV/REV, etc.). With certain adjustments, e.g., including the smaller size of your company versus the public company, which decreases the multiple, this range of multiples should provide you reasonable guidance. Next, multiply the EBITDA of your company by this range and you will have calculated a valuation range for your business. However, this process (called “comparable companies analysis) may be unreliable because it is based upon today’s market prices, which may be volatile. It may also be inaccurate as many adjustments need to be made to the multiple. For example, if your company has high customer concentration or a union, it's likely that your multiple will be penalized versus other companies in your industry.

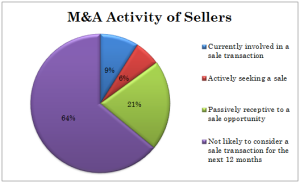

Another way to calculate a multiple range is to look for comparable companies that have recently been purchased via M&A transactions . If you can attain the purchase price for a similar company, as well as its relevant financial metric (revenue, EBITDA, etc.), you can calculate its multiple. This is actually a more valid multiple range, provided the data is current. However, this process of “precedent transactions analysis” can be inaccurate because some strategic buyers place a high “purchase premium” when acquiring certain companies, which results in a valuation far above fair market price. In addition, economic conditions may have changed since the time of the previous purchases, so that the multiple range might reflect different market conditions.

The valuation derived from these methods serves as a starting point when discussing company value with your M&A advisor. However, it is just that-- a starting point. It is important to remember that valuation multiples are based on comparisons to similar businesses, yet no two companies are the same. Your company may operate in the same industry and provide a similar service/product as another company, but there are certain unique characteristics of your business that may result in a higher or lower multiple than expected. For example, Company A has similar EBITDA to Company B in the same industry. However, Company A commands a higher valuation because it is deemed a higher quality business due to superior management, branding or other reasons.

There is a fundamental flaw in the structure of the multiple. The denominator represents a financial metric-- such as EBITDA. However, EBITDA is an imperfect proxy for free cash flow because true free cash flow includes taxes, working capital, and capital expenditures while EBITDA does not. And free cash flow truly drives the value of a business. Thus, buyers will often stray from the simplistic EBITDA*multiple valuation that the business owner expects to receive because buyers base their bid on true free cash flow generation and other important factors. Therefore, a business owner should not be surprised if the initial valuation projection via a multiple is too high (or too low). Valuation is truly an art, and an M&A advisor like the Versailles Group can perform an in-depth financial analysis to help a seller target a fair, but full valuation for his or her business. Furthermore, marketing the company properly will find the best possible buyers, which will always result in the best possible valuation.

Founded in 1987, Versailles Group is an independent, middle market boutique M&A firm and offers its clients access to buyers and sellers worldwide. The firm provides its clients with a high level of personal attention coupled with over 28 years of cross-border transaction experience. Clients benefit from world-class advice, broad expertise, and flawless execution. As one of the leading middle market investment banking firms in Boston, the firm’s focus is obtaining superior results for its clients. That’s the primary reason why Versailles Group has done more repeat business than any other middle market firm. The net result for our clients is a superior transaction, whether it is on the buy or sell-side.

If you are interested in buying or selling a business, please contact us for a free consultation.

Donald Grava

Founder and President

Versailles Group, Ltd.

617-449-3325