Why should you sell your business to an overseas buyer?

Why should you sell your business to an overseas buyer?

If you’re an entrepreneur interested in selling your business, it is now more important than ever to consider overseas buyers. Due to the progressive globalization of the world economy virtually any company interested in M&A stands to gain from participating in the international market, regardless of that company’s size.

For overseas buyers, acquiring an American business is often an attractive option because it allows them easy and strategic access into the lucrative American market. International buyers might also want to acquire an American company because they consider the United States to be a relative safe haven from more volatile foreign markets. Buyers may even be motivated by the desire to gain an investment visa through such a transaction.

The high demand among overseas buyers plays directly into the favor of the sellers. When it comes to selling your business, the more options you have, the better. For instance, you could sell your company to an overseas party if no domestic parties make a reasonable offer. In another scenario, the presence of a possible overseas buyer(s) for your company could even spur other prospective buyers to make more aggressive bids and pushing an auction to even greater heights for valuations.

This is the primary reason why all American entrepreneurs should keep overseas buyers in mind. The international market will open new doors for both you and your company. For instance, say that you’re trying to sell your company to domestic buyers, and your best offer is US $20 million. If you’ve only bothered to search domestically, you’ll have no choice but to accept that offer. However, imagine that you had searched for buyers in the international market as well. Perhaps you would’ve found a buyer in Brazil also willing to pay US $20 million, forcing your American buyer to increase its bid to $22 million. Or maybe you would’ve found a buyer in South Africa willing to pay US $30 million! It has certainly happened before, and it can certainly happen again.

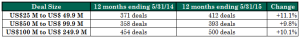

Versailles Group, a 28-year-old Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world. Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987. More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For more information, please contact

Donald Grava

Founder and President

617-449-3325