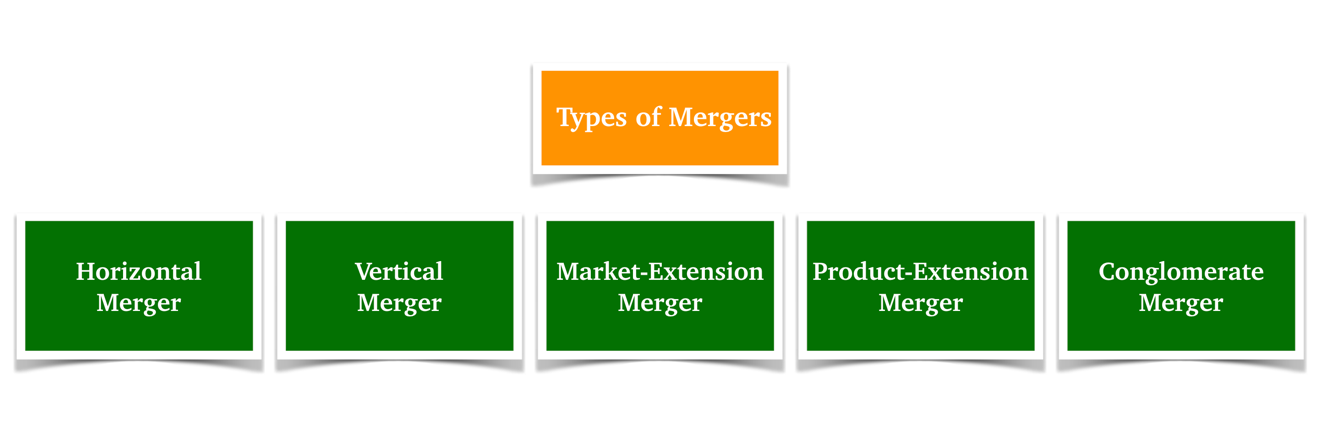

There are five different types of mergers and the purpose of this blog is to describe these in more detail. This writing is not meant to be a comprehensive description of each, but rather an introduction.

A merger is an agreement that unites two existing companies into one new company. Generally, mergers are done to expand a company's reach, expand into new market segments, or to gain market share. Most of the time, mergers and acquisitions are done for either offensive or defensive reasons.

The Five Basic Types of Mergers

1. Horizontal Merger: This is a merger between companies that are in direct competition with each other in terms of product lines and markets.A famous example of a horizontal merger was the merger between HP (Hewlett-Packard) and Compaq in 2011. The successful merger created a global technology leader valued at over US$87 billion.

2. Vertical Merger: A merger between companies that are in the same supply chain.Example: Walt Disney acquired Pixar Animation Studios for US$7.4 billion in 2006. Pixar was an innovative animation studio and had talented people. Walt Disney was a mass media and entertainment company. By combining forces, they created a very powerful company in their industry.

3. Market-Extension Merger: A merger between companies in different markets that sell similar products or services. The motive behind this type of merger is to make sure that the merging companies will be able to operate in a bigger market and thereby gain large numbers of new clients.A good example was RBC Centura’s merger with Eagle Bancshares Inc. in 2002. This market-extension merger helped RBC with its growing operations in the North American market.

4. Product-Extension Merger: A merger between companies in the same market that sell different but related products or services. For this kind of merger, the products and services of both companies are typically not the same but are related. The key is that they utilize similar distribution channels and common, or related, production processes or supply chains.An example of a product-extension merger would be the merger between Mobilink Telecom Inc. and Broadcom. The two companies both operate in the electronics industry and the resulting merger allowed the companies to combine technologies and extend their market reach.

5. Conglomerate Merger: A merger between companies in unrelated business activities, e.g., a clothing company buying a software company. In other words, two totally different businesses. These types of mergers are also further defined as:

- Pure Conglomerate: In this case, the two companies have nothing in common. An excellent example of a Pure Conglomerate merger was the creation of W.R. Grace a specialty chemicals and industrial business that went on to buy over 150 different businesses, including retail outlets (Herman's Sporting Goods, Channel, Handy Dan, Angels, Diana, Sheplers), food chains (Del Taco, Coco's, Moonraker, Plankhouse, Houlihan's Old Place), coal, oil and natural gas (Booker Drilling, TRG, Homco & A-1 Bit & Tool, Davison cracking catalysts), construction (Zonolite insulation), graphic arts (Letterflex printing systems), chemicals (Dartak emulsion polymers, Evans sulfur compounds), agriculture (phosphate and nitrogen-based fertilizers), and hospital products (Vestal disinfectants).

- Mixed conglomerate: Mixed conglomerate mergers are ones where the two companies that are merging with each other have the goal of gaining access to a wider market and client base or expanding the range of products and services that are being provided by the respective companies. A possible example of this might be a merger of Bank of America and Starbucks, which would broaden both companies’ customer bases and product ranges. To some extent, Capital One is already pursuing this strategy via its cafes.

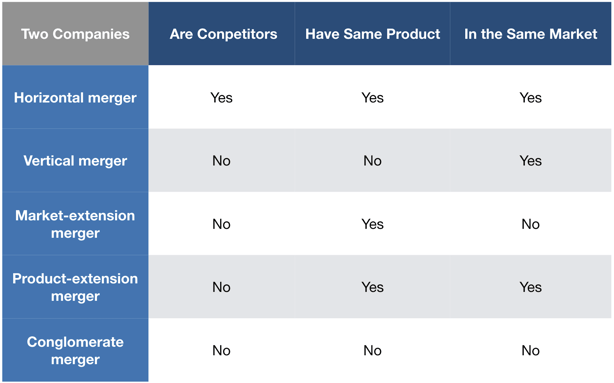

Listed below is a table that summarizes the different types of mergers.

Written by He (Henry) Wang

2 April 2020

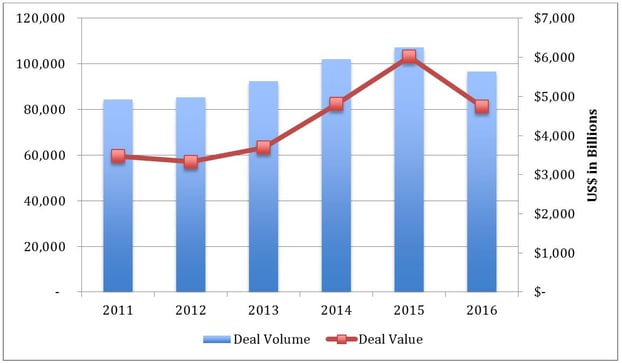

Versailles Group is a 37-year-old boutique investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues greater than US$2 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For additional information, please contact

Founder and President - Versailles Group, Ltd.

+617-449-3325