M&A in Brazil - Bargain Hunt

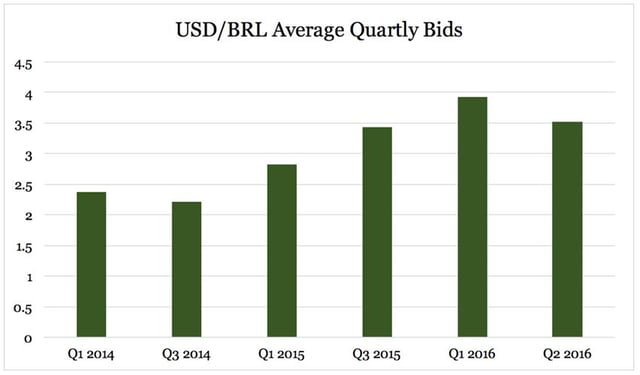

At this point in time, Brazil is providing M&A buyers with incredible opportunities for a number of reasons. Despite a history of healthy economic growth, Brazil’s economy has recently lost momentum. The country has officially been in a recession since the end of 2014, with no immediate recovery in sight. Inflation is now over 10%, and unemployment reached 9% in 2015. Additionally, the Brazilian stock market has plummeted along with its currency. The chart below depicts the decrease in the value of the Brazilian real in comparison to the US dollar.

Compounding the economic problems, Brazil is experiencing temporary political unrest due to a large corruption scandal. There isn’t much hope for economic improvement in 2016; however, once the political turmoil settles, economists are optimistic about what 2017 will bring for the Brazilian economy. Brazil boasts a large domestic market, with a variety of innovative industries and an abundance of natural resources. The previous decade’s economic growth averaged around 4 to 5 percent per annum. It is likely that the economy will start to grow at the tail end of this crisis, as the Brazilian government has plans to address the economic problems in the form of cutting public spending and implementing policies through the Central Bank.

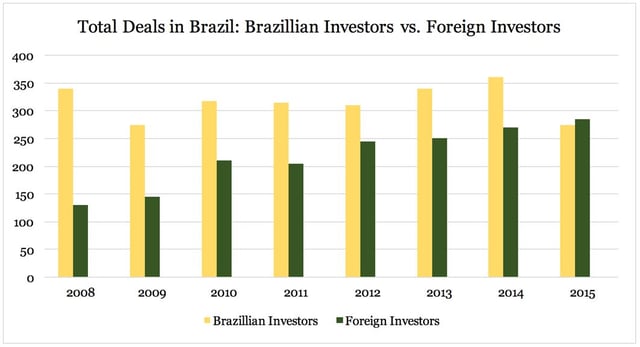

What does this mean for foreign investors? Brazilian companies are the cheapest they have been in years, and with a vast array of investment options. In short, Brazil presents a unique opportunity. This is echoed by the fact that foreign investors are flocking to the region, and are beginning to outpace local investors. The chart below compares foreign investors to Brazilian investors.

M&A buyers that can look beyond two or three years will be able to achieve excellent returns. The Brazilian economy has the capability for strong and consistent growth. Over the years, the middle class in Brazil has grown, literacy rates have increased, and Brazil is the 8th or 9th largest economy in the world.

In conclusion, an M&A buyer can capitalize on the current domestic situation, which has resulted in slashed valuations and many opportunities where sellers have to sell. Furthermore, foreign investors will also be able to capitalize on the strong US dollar as compared to the Brazilian Real, which make Brazilian acquisitions incredibly affordable and will enable investors or acquirers to earn a healthy return on their investment in the future.

Versailles Group is a 29-year-old Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For additional information, please contact

Founder and President

+617-449-3325

July 20, 2016