M&A Activity - First Half 2016

Top Five Countries

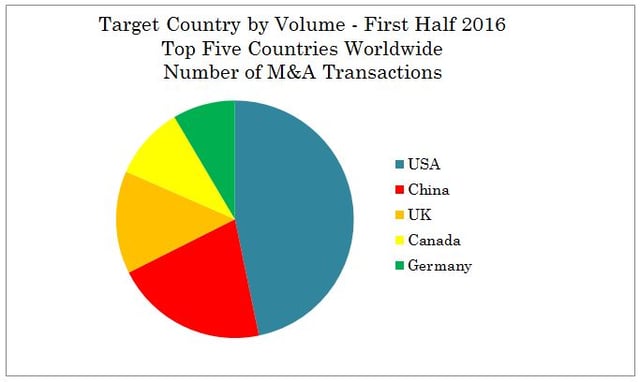

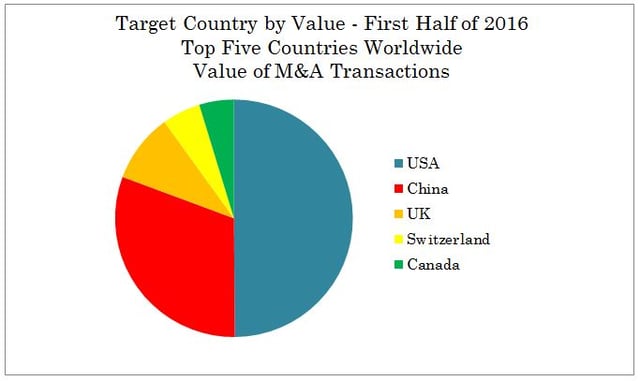

With regard to M&A in the global arena, it’s fascinating to observe which countries attract the most activity and how that evolves over time. The charts below reflect the top five countries with the highest deal value and volume for the first six months of 2016.

The United States and China have been able to maintain their M&A leadership in the first half of 2016. In terms of deal volume—the number of transactions completed worldwide—the US accounted for 23% of the deals completed while China captured 10% of the deals worldwide.

The chart below represents the number of M&A transactions completed by country in the first six months of 2016. The US and China dominate this category, with 10,151 and 4,519 deals completed respectively. When compared to the first quarter, the breakdown by volume for these five countries has remained remarkably similar. Each country has been able to continue closing deals at roughly the same pace.

Represented in the chart below is the value of M&A transactions completed by country, for the top five countries, in the first six months of 2016. The US and China are again leaders in this category. Collective deal value in the United States reached US$633,441MM, and China’s total transactions were valued at US$390,570MM. Switzerland remains in the top five countries for deal value, which is uncommon; however, during Q1 Syngenta was acquired by ChemChina, and this one large deal is in part responsible for Switzerland’s high rank.

Two countries to keep an eye on for the remainder of the year are Australia and France. Lately, Australia has been receiving media attention for potential growth in M&A deals. For the first half of 2016, Australia came in only 282 deals behind Germany. It will be interesting to see if Australia is able to push up into the top five countries for volume next quarter. Likewise, France is trailing Canada in the rankings for deal value so far in 2016. As M&A activity is likely to experience shifts throughout Europe after the Brexit vote, M&A activity by county may look slightly different next quarter.

Versailles Group is a 29-year-old Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For additional information, please contact

Founder and President

+617-449-3325

August 4, 2016