M&A - Financial Versus Strategic Buyers

M&A - Financial Versus Strategic Buyers

M&A buyers are usually classified as either strategic or financial buyers. Strategic buyers are companies actively pursuing opportunities to grow or diversify their revenue sources in the seller’s market. Strategic buyers represent about 70 percent of the total M&A market. Usually, a strategic buyer will have something in common with the selling company; they can be competitors, suppliers, customers, or even an unrelated company with a complimentary product looking to gain access to the seller’s industry, market, or business. Ultimately, they are looking for a company with attributes that can be integrated into their established business strategy to create synergy - the concept that the value of two companies combined is greater than the sum of the separate individual parts. (Sometimes, strategics make acquisitions to diversify.)

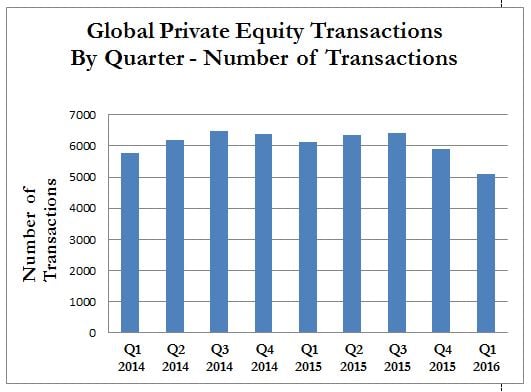

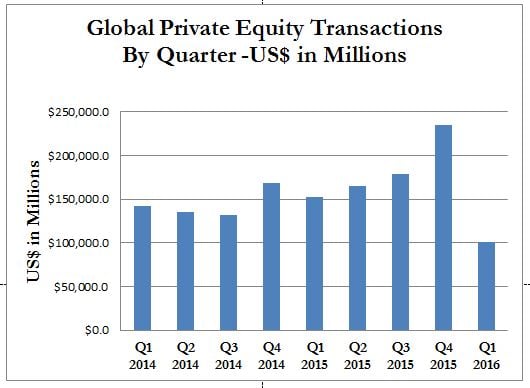

Financial buyers look for good businesses they can build up over a few years and then sell to make a profit. Private equity, venture capital, family offices, and some hedge funds are good examples of financial buyers. Their acquisitions comprise the remaining 30 percent of the M&A market. They look for growth prospects, good management, and future exit opportunities. Rather than integrate the company into their own, they work with the seller’s management team to understand what resources they need and help obtain them, in an effort to foster growth.

During the Transaction

Understanding the end goals of both financial and strategic buyers is essential to understanding how and why their approaches differ. After the transaction, a strategic buyer will consolidate the target business with their business systems, controls, and management to recognize synergies from the integration of the two organizations. If it’s a total integration, this may present a challenge for a seller that is looking to remain active in the company. In this case, the best alternative is a financial buyer, who typically allows the company to run as a stand-alone entity. In contrast, the financial buyer’s goal is to improve the business operations in order to make the company a more attractive investment to a future acquirer.

Efficiency of the Transaction

Typically, a financial buyer has completed many deals before and has developed a kind of “playbook” to follow making the process flow along more efficiently than an inexperienced strategic buyer. However, financial buyers tend to be more thorough in their diligence, for a couple reasons. First, they have to take the time to learn about the industry they will be entering, whereas a strategic buyer generally has strong industry knowledge and has already developed an outlook for the future. Additionally, things that may make sense to a strategic buyer may become an issue for a financial buyer who doesn’t understand industry norms.

Secondly, a financial buyer is more likely to keep the current personnel in place than a strategic buyer. Thus, the diligence process will have a stronger focus on the infrastructure of the target company. Effectively, strategic buyers will focus on validation and the ability to integrate the target into their business model and financial buyers, in addition, will have to study the business model, the personnel, and much more.

Consideration

One of the most important issues for sellers is the amount of consideration paid by each type of buyer. Generally, a strategic buyer will offer greater consideration than a financial buyer. In essence, financial buyers are purchasing explicitly what the company has to offer. They buy the expected future earnings, in hopes to expand the cash flow beyond what the company has done previously, but they do not pay for that potential. Usually, a strategic buyer will pay a premium to recognize the synergies that make the transaction attractive. Almost immediately after closing, a strategic buyer will recognize synergistic benefits. These benefits can be attributed to various factors that will depend on the organizations involved but can include greater market share, combined talent, and cost reduction. Most importantly, the more realizable the synergies are, the more the purchaser will be willing to pay.

There are also defensive reasons for a strategic buyer to pay a premium. Suppose there are three companies who sell the same product; two with large distribution networks and significant market share. The third company lacks the sales capability but they know how to produce the product for much less. If the third company were to sell itself, it would make sense that the other two would pay a significant premium to prevent the other from acquiring the low cost producing seller. In this scenario, a financial buyer would be outbid as they would be unwilling to pay a defensive premium.

While the differences between strategic and financial buyers are evident, there is no clear answer as to what type of buyer is best for a seller. The best way to discover what is right for the seller is to reach out to both strategic and financial buyers. Understanding the characteristics and intentions of the target and acquiring entities is essential in making the right decision. Aside from the obvious benefits of fostering competition, reaching out to both types of buyers present the opportunity for the seller to see more options and ultimately better understand what is in their best interest. It’s also the best way to drive the highest possible valuation.

Versailles Group is a 29-year-old Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987. More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For more information, please contact

Donald Grava

Founder and President

+617-449-3325

May 18, 2016