Technology Sector M&A Activity

(Please click the chart for easier reading.)

Technology Sector M&A Activity

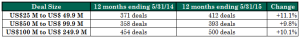

Across all sectors, M&A activity, for the twelve months ending May 31, 2015, has increased relative to the same time period last year. Both strategic and financial buyers are completing more acquisitions because of the recovering US economy, the impending interest rate hike, and other factors. The data above illustrates the increase in M&A deal volume in the middle market.

The technology sector has accounted for most of the increase in deal volume. In the last three months (March-May 2015), there were 526 deals completed in technology services-- more than any other sector. That number is up from 477 technology services deals completed from March-May of 2014.

The need to innovate, grow, and keep pace with the changing technological landscape is fueling M&A volume in the technology sector. Technology companies are increasing their IT capabilities via M&A strategies to scale their operations, develop domain expertise, or for growth prospects.

The rationale for acquisitions in the technology sector is strong: internet data traffic is expected to triple from 2014-2019. In addition, 50% of this internet traffic is expected to come from devices other than traditional desktops. Technology companies are acquiring businesses that enable them to ensure growth through the development of new technologies or to penetrate new markets.

Whether it's a tech company or not, if you are interested in completing an M&A transaction there is no better time than now. The looming interest rate increases, possible change of political party, world events, etc. are driving people to complete deals before it's too late.

Founded in 1987, Versailles Group is an independent, middle market boutique M&A firm and offers its clients access to buyers and sellers worldwide. The firm provides its clients with a high level of personal attention coupled with over 28 years of cross-border transaction experience. Clients benefit from world-class advice, broad expertise, and flawless execution. As one of the leading middle market investment banking firms in Boston, the firm’s focus is obtaining superior results for its clients. That’s the primary reason why Versailles Group has done more repeat business than any other middle market firm. The net result for our clients is a superior transaction, whether it is on the buy or sell-side.

If you are interested in buying or selling a business, please contact us for a free consultation.

Donald Grava

Founder and President

Versailles Group, Ltd.

617-449-3325