Over the past four quarters, there has been significant growth in M&A activity in the middle market of Latin America and the Caribbean. Both the number of M&A deals, aggregate value, and average value of M&A transactions in these regions have increased substantially.

The number of deals have increased in each quarter, from 45 in Q3 of 2011, to 83 in Q4 of 2011, to 107 in Q1 of 2012, and finally to 135 in Q2 of 2012.

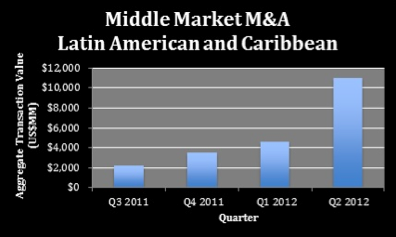

Additionally, the aggregate value of these transactions increased substantially, from US$2,203MM in Q3 of 2011 to US$11,043MM in Q2 of 2012.

In terms of the average value per transaction, the first three quarters mentioned had fairly consistent figures (US$48.9MM, US$41.9MM, and US$43.6MM). However, Q2 of 2012 saw an 87% increase in the average value per transaction, jumping to US$81.8MM. A portion of this spike can be attributed to the M&A activity in energy and consumer staples, which experienced exponential increases.

As a result of these drastic increases in M&A activity, Brazilian middle market M&A now represents 31% of all middle market M&A deals in Latin America and the Caribbean. There are a number of reasons for this, including currency factors, changes in antitrust laws, growth in infrastructure projects in Brazil related to the impending Olympic Games and World Cup events, etc.