Projections indicate a rebound in M&A transactions, with a 13% rise in deal volume projected for US private equity and a 12% increase for corporate M&A. This positive outlook for 2024 M&A activity may stimulate greater buyer interest and lead to higher valuations.

In the fast-paced world of dealmaking, various economic indicators, geopolitical tensions, and market sentiments are interconnected, which can lead to significant shifts in the market landscape in a short period. Over the past several years, we have witnessed a fascinating journey in M&A activity, from record highs due to favorable economic conditions to sudden downturns triggered by policy changes. This rollercoaster ride offers valuable insights into the complexities of dealmaking and the strategies that emerge amidst uncertainty.

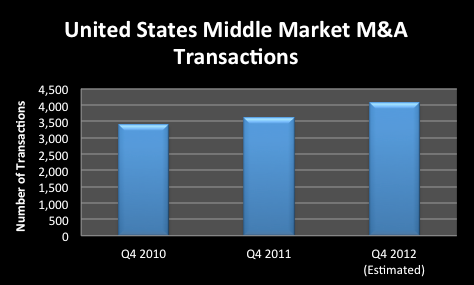

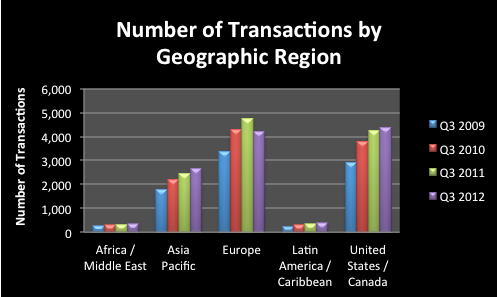

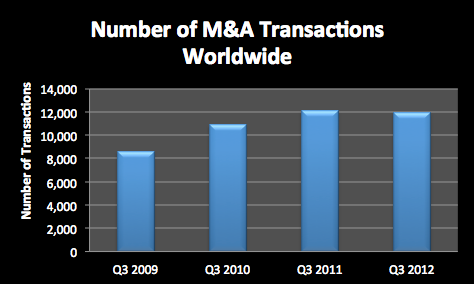

In 2021 and early 2022 historic highs in M&A activity were driven by favorable economic conditions, such as moderate inflation, robust economic activity, and low interest rates. However, the Federal Reserve's historic tightening cycle in March 2022 triggered a sudden pullback, and dealmaking activity slowed significantly as the cost of capital surged, and uncertainties loomed large. Private equity deal volumes in the US were substantially lower in 2023 compared to the peak observed in 2021, with a similar trend observed in corporate M&A transactions. These numbers underscore the ripple effects of macroeconomic shifts on the dealmaking landscape, serving as a barometer of broader economic trends.

Despite the downturn, there are glimmers of optimism for the future, as a CEO outlook survey hints at a renewed enthusiasm for deal activity. A significant proportion of US CEOs expressed interest in completing M&A transactions in the coming months, with joint ventures and strategic alliances emerging as key alternative strategies for navigating uncertainties. This reflects a shift towards collaborative approaches to innovation and growth. The survey highlights the emphasis on investments in generative AI (GenAI), indicating a growing recognition of the transformative potential of emerging technologies. While uncertainties linger regarding the trajectory of AI development, the willingness to invest underscores a proactive stance toward embracing innovation and driving future growth.

There is an optimistic future for M&A, with a gradual recovery in PE M&A activity expected through 2024, following a 19% contraction in 2023. It is predicted that there will be a 13% increase in PE deal volume in 2024, which would still leave deal activity about 8% below the 2022 level and 18% below the 2021 peak. While the shortfall relative to recent peaks will be notable, the more important development is that PE deal volume growth is likely to surpass its pre-pandemic pace next year. Between 2010 and 2019, PE deal volume grew at a 9% compounded annual growth rate (CAGR).

The journey of M&A activity in recent years has been remarkable, with periods of prosperity and uncertainty. Economic indicators, policy decisions, and market sentiments all play a significant role in shaping the landscape of dealmaking. Although challenges may arise, businesses have shown resilience and adaptability, using proactive strategies and collaborative approaches to pave the way for future growth. With optimism for a gradual recovery on the horizon, we should embrace the lessons learned and the opportunities that lie ahead. Agility, foresight, and a willingness to embrace change will be the keys to success in the fast-paced world of dealmaking.

Written by Brigitte Grava

5 March 2024

Versailles Group is a 37-year-old boutique investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues greater than US$2 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For additional information, please contact

Founder and President - Versailles Group, Ltd.

+617-449-3325