Quarterly M&A Comparison

Globally, both the volume and value of M&A transactions slowed in the first quarter of 2016. Private Equity transactions were not exempt from this slowdown, which is being caused by tightening credit to finance transactions, election uncertainty, and lower confidence in the economy.

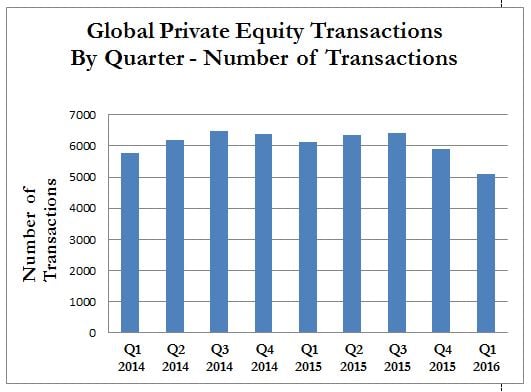

With regard to the volume of Private Equity transactions, the following chart depicts the Q1 2016 slowdown. More specifically, Q1 2016 was almost 17 percent lower than Q1 2015.

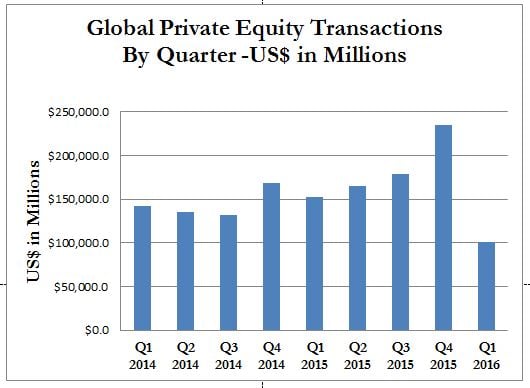

With regard to the value of Private Equity transactions in the first quarter, the slump in the number of completed transactions was even more apparent. The value of transactions in Q1 2016 versus Q1 2015 decreased by 34 percent. The major factor contributing to this was the simple fact that there was a dramatic slowing of very large transactions.

Private Equity buyers still have plenty of “dry powder” and continue to look for transactions across all sectors. Their investors are always looking for good returns, which can only happen if the Private Equity firm is invested. In addition, while Private Equity buyers frequently don’t outbid strategic buyers, they do offer competitive valuations. Furthermore, they provide business owners that are selling a very viable alternative with lots of other benefits.

The key to closing a successful transaction, particularly if the goal is to do that in 2016 is to explore the topic and develop definitive objectives. Many sellers wait too long or have this fuzzy notion that a qualified buyer will seek them out. Neither scenario achieves the best value.

Versailles Group is a 29-year-old Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987. More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For more information, please contact

Founder and President

+617-449-3325

May 23, 2016