M&A Deals - Hockey Stick Projections

M&A Deals - Hockey Stick Projections

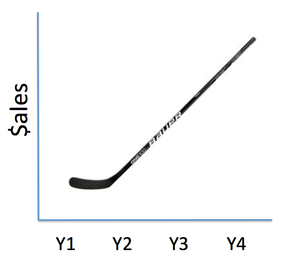

During the deal making process, there are a number of common mistakes that can cost sellers millions of dollars. Many of these mistakes can be avoided by simply hiring an experienced M&A team to guide the parties through the transaction. One common mistake committed by sellers in M&A deals is the use of “hockey stick” projections in sales growth.

A hockey stick projection, depicted above, is an unrealistic forecast for future sales growth. These projections portray a growth rate substantially higher than what the company has traditionally achieved, and often times make the seller appear not credible. Overly optimistic projections are a mistake that many sellers make in an attempt to fetch higher valuations for their companies; however, from a buyer’s perspective a hockey stick sales growth usually raises suspicions over the validity of the forecasts and other information.

The buyer’s due diligence process will examine all aspects of the target company and expose the unrealistic nature of the lofty projections. In many cases, a seller will attribute the growth rate to estimates made by the sales team or expected catalysts foreseen in the market. But, the buyer will want to check the forecasting methodologies of the sales team and validate the proposed market catalyst. The buyer’s due diligence team and M&A advisor will thoroughly evaluate the seller’s data, obtain expert opinions, and research the assumptions and economics behind the projections. Ultimately, if the seller’s forecasts cannot be substantiated, potential buyers will lose faith in both the future performance and management of the company. As a result, potential buyers will either walk away from the deal or make offers at many multiples below the industry average.

The stakes are high during an M&A transaction, with average deal values in the millions of dollars. Consequently, mistakes can prove to be very expensive. The mistake of making hockey stick projections is one that can shatter deals and put far less money in a seller’s pocket. Careful preparation of valid sales forecasts and the advice of experienced deal makers will eliminate this mistake from the process. In fact, when buyers find solid rationale and data behind forecasts, they are more likely to pay a higher price for the company.

To conclude, for M&A deals – hockey stock projections do not add value, they actually diminish the value.