M&A Deals - Q1 IT Update

M&A Deals - Q1 IT Update

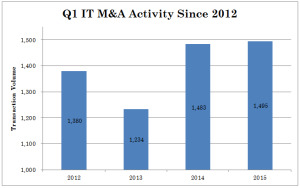

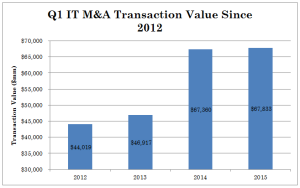

With regard to M&A deals - Q1 IT update, IT deals for the first quarter of this year are slightly ahead of the same period last year in terms of both volume and value. Approximately 1,500 transactions were closed with a value of approximately US$67.8 billion.

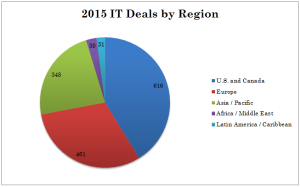

By region, 616 of the approximately 1,500 transactions (or about 41 percent) were announced in the US and Canada. Europe accounted for 461 transactions or about 31 percent. Approximately 348 transactions were announced in the Asia Pacific region for about 23 percent. Here are the details:

Versailles Group, founded in 1987, is an expert at closing successful M&A deals. Software transactions have included the sale of Bedford Software, a Toronto Stock Exchange listed company, the sale of Layered Inc., a company owned by Mr. Paul Allen, co-founder of Microsoft, the sale of BEZ Systems, the sale of a software business for Logica plc, etc. Versailles Group's forte is to listen to its clients objectives and works diligently to find the appropriate buyer. In these cases, high valuations are achieved and both buyer and seller are happy with the results.

Versailles Group was founded by Mr. Donald Grava, who has an extensive background in accounting, finance, M&A, and other matters. Mr. Grava started his M&A career on Wall Street in New York, where at an early stage in his career, he was exposed to international companies and cross-border transactions. As a result, many of Versailles Group's transactions have been cross-border.