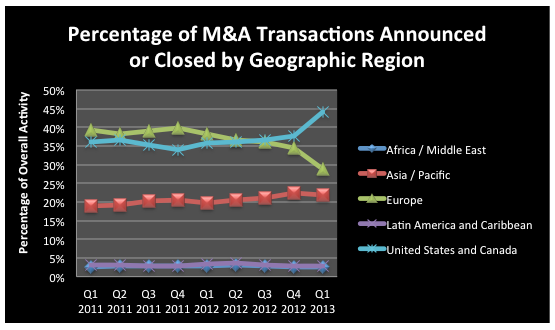

Over the past few years, the M&A landscape has changed quite dramatically from a geographic standpoint. As we’ve mentioned in the past, M&A activity in Europe has seen a quite precipitous decline, with associated increases in M&A activity in the United States / Canada and Asia / Pacific regions, and we fully expect this trend to continue in the near term.

The one region that has failed to receive much M&A attention is Africa / Middle East, which, in the chart above, follows nearly the same path as that of the Latin America and Caribbean region; however, it appears that there may be a sharp increase in M&A activity in Africa over the next three to five years.

Africa has a plethora of natural resources, such as oil and natural gas, iron ore, copper, etc. Many Chinese companies have already recognized the value and invested in these areas. As companies with large cash positions from other regions of the world start to deploy their capital to develop these natural resources, there will be a noticeable uptick in M&A activity in Africa.