2016 Global M&A in Review – US Led the Way

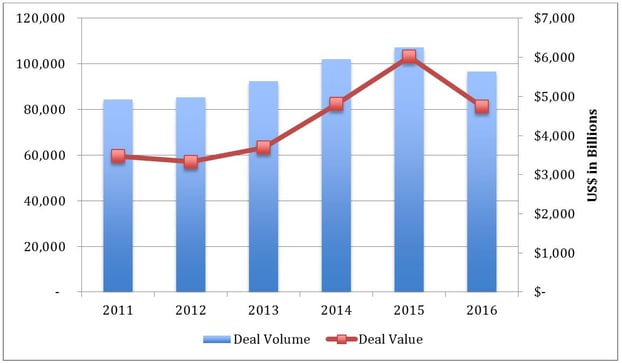

In 2016, there were 96,665 M&A transactions closed with an aggregate value of US$4,734 billion. In terms of deal value, 2016 was the third best year since 2007, significantly higher than any other year and only slightly surpassed by 2014, the second best year when US$4,802 billion of transactions were completed. That being said, 2016’s M&A activity was definitely lower than 2015.

Global M&A Activity by Volume and Value

In 2016, the US once again topped the rankings by both volume and value. Specifically in terms of deal value, US$1,617 billion of transactions were closed during the year. Some of this activity can be attributed to the burst of mega deals led by Time Warner’s US$109 billion acquisition by AT&T, which was the largest transaction in the US, the second largest M&A deal globally, and one of the only two global deals worth over US$100 billion during the year.

Following the US’ leading position, China was second with a value of US$789 billion. The largest deal by value involving Chinese targets was the transaction between China National Petroleum Corporation and Jinan Diesel Engine in a reverse takeover worth US$11 billion in December. Chinese companies completed ten of the top 20 deals in Asia-Pacific in 2016.

The UK was third with US$420 billion of transactions. The largest deal by value in the UK involved Anheuser-Busch InBev’s US$124 billion acquisition of SABMiller, which was also the largest globally.

With strong M&A performance in the US, China, UK and other countries combined with an environment that is conducive to M&A, sellers or buyers should have the confidence to embark on a transaction in 2017.

Candidly, now is the best time to make plans to complete a transaction in 2017. Sellers should act before buyers/investors’ investment plans and funds have been devoted to other transactions. Buyers should take advantage by identifying the highest quality targets and moving on them quickly to avoid competitive bidding situations.

Versailles Group is a 30-year-old boutique investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues greater than US$2 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For additional information, please contact

Founder and President - Versailles Group, Ltd.

+617-449-3325

7 February 2017