Consumer Products M&A Update

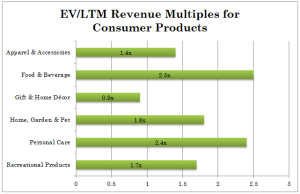

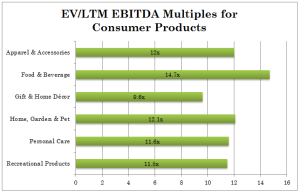

With regard to consumer products multiples, it’s interesting to observe the differences in valuations between the various segments. Whether the metric is enterprise value divided by last twelve month’s revenue (“LTM”) or enterprise value divided by last twelve months EBITDA, Food and Beverage commands the highest multiples. (We explain why below.)

Gift & Home Décor seems to garner the lowest valuations in this sector. But, “low” doesn’t mean bad in this case. A multiple of 9.6 times EBITDA is very respectable for this niche.

In the consumer space, strategic acquisitions are a relatively quick way for buyers to keep pace with emerging consumer trends. For example, there are a number of soft drink companies that have acquired water companies, sports and energy drink companies, etc. The purpose of these acquisitions was to respond, very quickly, to customer demand. This heightened demand and competition for companies in this niche translates into higher multiples and values as depicted in the charts above.

Since 1987, Versailles Group's skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world. Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987.

If you would like to discuss strategic options, please contact me.