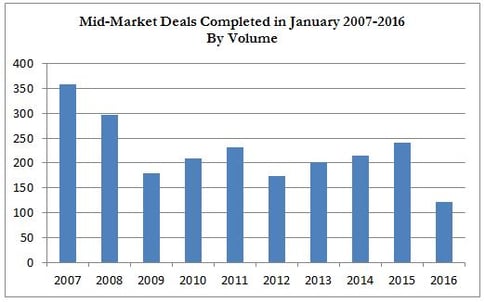

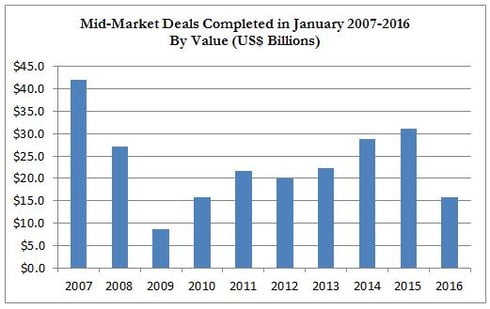

Middle market M&A activity, as measured by volume, was the lowest that it has been in 10 years. By value, M&A activity in January was the lowest since 2009.

There are many theories about why this is happening, for example, a volatile stock market, declining energy prices, rising interest rates, the slowing of China’s economy, and uncertainty caused by the US election process. We would not deem this to be a trend unless we see this continue for a few months.

For sellers, multiples seem to be dodging this lower level of activity. And, in the lower middle market, that is, companies with less than US$100 million in revenues, there seems to be plenty of interest, activity, and definitely no degradation of multiples.

As we’ve all noted, the Fed may not be able to raise interest rates, energy prices can’t fall much more, and an election won’t stop people from completing synergistic or opportunistic transactions. Thus, there are plenty of good opportunities on both the sell and buy side.

If you’re interested in completing a transaction in 2016, either buy-side or sell-side, now is a good time to explore and develop objectives.

For over 29 years, Versailles Group's skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987.

If you are interested in discussing your M&A objectives, please do not hesitate to contact me.

Sincerely yours,

Donald Grava

Founder and President

617-449-3325 (Direct)