M&A Deals

Healthcare M&A Deals

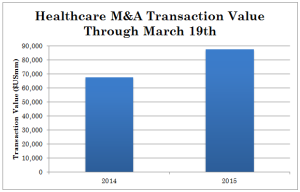

Healthcare M&A deals are off to an excellent start this year as evidenced by the chart below, which shows the increase in value of M&A deals from January 1 to March 19 of this year as compared to the same period last year.

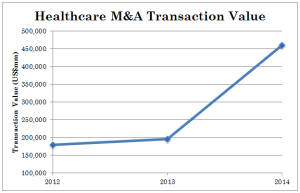

This strong M&A activity continues a trend of increasing transaction values in the Healthcare sector. Since 2012, the aggregate value of healthcare M&A deals has grown 157 percent.

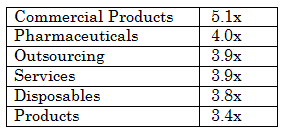

In terms of revenue multiples, and M&A deals, the following segments had the highest multiples:

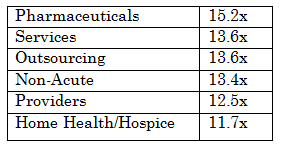

In terms of EBITDA multiples and M&A deals, the following segments had the highest multiples:

Most people watching healthcare M&A deals in 2015 believe that it will be a very strong year in terms of numbers of transactions and the value of such transactions. The Affordable Care Act is pushing companies to get larger and larger to achieve economies of scale in order to compete effectively. From our vantage point, it appears that healthcare companies need to get larger or they won’t be able to compete in today’s more demanding marketplace.

For companies on the acquisition “trail,” it’s imperative to have an experienced M&A advisor on the team to help refine the acquisition criteria so that important transactions are not missed. With clear criteria, targets can be identified and contacted quickly to make the process as efficient as possible. Furthermore, if a number of targets are contacted at once, the buyer gains valuable strategic market information, can complete comparison “shopping,” and conclude the best possible M&A deal.

For healthcare companies interested in selling, it’s important to have an M&A advisor that can properly identify, worldwide, every possible buyer in order to create the best possible auction. An experienced Investment Bank should be able to create a worldwide, silent auction in order to make sure that a proper market is made for the seller. The second and third bidders will also keep the “winner” honest during the due diligence phase. Furthermore, should the “winner” not be able to complete the transaction, for any reason, the second and third place bidders should be considered as excellent back up buyers.