Quarterly M&A Comparison

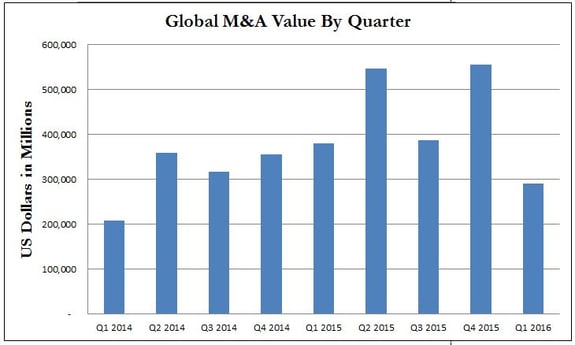

Global M&A activity in the first quarter of 2016 decreased in comparison to the last eight quarters.

As depicted in the graph below, in terms of volume, Q1 2016 was the lowest in the past two years. Despite the decrease, there were still approximately 20,000 transactions completed in just three months.

In terms of the aggregate value of M&A transactions, Q1 2016 was not the lowest in the past eight quarters. Q1 2014 was actually lower. The reduction of value reflects a slowing of mega-mergers, which sometimes skew the statistics particularly when one is focused on the lower middle market.

In the lower middle market, M&A activity remains robust, but it's important for both buyers and sellers to make sure that they are addressing the entire market. For example, sellers should make sure that they are contacting buyers internationally. Buyers should make sure that they are contacting targets in their entire marketplace to insure that they have the ability to comparison shop and complete the best possible transaction.

One of the biggest challenges to completing an M&A transaction is to make sure that the buyer or seller have engaged a well-experienced advisor that has experience in the international arena. The world has gotten “smaller,” largely due to the improvements in communications. In the “old” days, say prior to 1982, international telephone calls were extremely expensive, faxes didn’t exist, and telex was a worldwide standard, but slow and expensive. To summarize, email, cheap telephone calls, etc. have made it easy for people to communicate worldwide. But, many M&A advisors don’t have the experience to deal with people with different customs and cultures. Versailles Group has nearly 30 years of dealing with buyers and sellers around the world. We use a culturally sensitive approach that allows us to successfully complete transactions that increase shareholder value on both sides of the negotiating table. Win win negotiating always works best!

May 11, 2016