M&A Activity in Western Europe

First Half of 2016

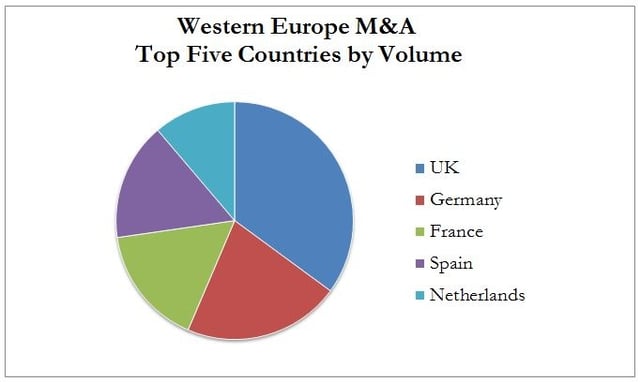

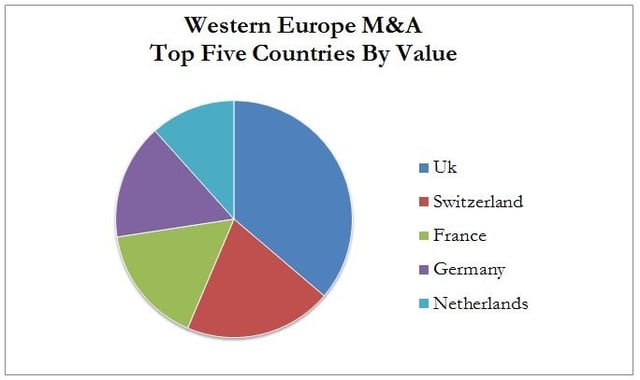

While the US and China receive the most media attention for M&A activity, Western Europe should not be overlooked. The charts below reflect the deal volume and value breakdowns for the Western European countries.

In terms of the number of deals completed in Western Europe, the two countries that have seen the highest activity are the United Kingdom and Germany. On a global level, these countries also rank well, and are usually within the top five countries for highest deal volume. The UK significantly outpaced German deals in the first half of 2016, closing almost 50% more transactions. It should be noted that Germany is completing significantly more deals in 2016 than they did in 2015. The chart below reflects the top five Western European countries with the greatest deal volume.

By deal value, the UK is still the leader in Western Europe for the first half of 2016 with their transactions totaling US$119,342MM. Surprisingly, despite its high volume of deals, Germany does not hold second place for deal value, but rather drops down to fourth. Switzerland has more than doubled its deal value as compared to the same time period in 2015, and holds second place in Western Europe. For the first half of 2016 Switzerland completed US$66,276MM in deals, as compared to the same period in 2015 when they had completed US$31,663MM. Shown in the chart below are the leading Western European countries with the highest deal value.

Post Brexit many have their eye on Western European M&A deals. It is expected that as the British Pound fluctuates against other currencies, so will the number of transactions between countries. While Brexit may help firms in the United States expand abroad at a reasonable price, overall deal activity within the UK is uncertain for the second half of 2016. Many believe the deal volume will fall, however some economists are optimistic about deal flow and predict it to pick up during the remainder of the year.

Versailles Group is a 30-year-old Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For additional information, please contact

Founder and President

+617-449-3325

September 15, 2016