When To Sell Your Business

When To Sell Your Business

One of the most important questions in M&A is: When To Sell Your Business?

M&A in the middle market is stronger than it has been in years. Now that the domestic economy is gaining traction, an increasing number of companies are becoming interested in making acquisitions. As a result of this robust demand, valuations have been driven higher in nearly every sector.

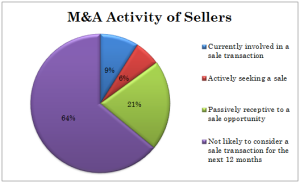

Despite these higher valuations, sellers continue to show hesitation when it comes to the sale of their companies. As shown in the chart below, only 9% of mid-sized companies in 2015 are currently involved in a sales transaction, while another 6% are also actively seeking to be sold. These figures have shown little change from 2014, when 6% of companies were being acquired and another 6% were seeking opportunities. In summary, companies are still hesitant to put themselves up for sale, despite strong demand for acquisitions and attractive valuations.

Right now, some of these companies may be unwilling to sell because they suspect that demand and valuations will reach even greater heights in the future. Yet timing the market is always difficult. M&A conditions in the middle market are currently very favorable for sellers and it is difficult to speculate how long these conditions will last. A decrease in demand from buyers or an increase in the number of sellers could reduce valuations as demand falls and supply increases. For sellers trying to receive the most consideration for their companies, the key is to be ahead of this shift.

To answer the question when to sell your business, the time is now. The market is strong, the multiples are high, and buyers are plentiful.

Founded in 1987, Versailles Group is an independent, middle market boutique M&A firm and offers its clients access to buyers and sellers worldwide. The firm provides its clients with a high level of personal attention coupled with over 28 years of cross-border transaction experience. Clients benefit from world-class advice, broad expertise, and flawless execution. As one of the leading middle market investment banking firms in Boston, the firm’s focus is obtaining superior results for its clients. That’s the primary reason why Versailles Group has done more repeat business than any other middle market firm. The net result for our clients is a superior transaction, whether it is on the buy or sell-side.

If you are interested in buying or selling a business, please contact us for a free consultation.

Donald Grava

Founder and President

Versailles Group, Ltd.

617-449-3325