Transportation and Logistics

High Growth Sector for M&A

The transportation and logistics (“T&L”) sector is experiencing substantial growth in global M&A activity. This sector had a strong Q1 2016, and activity increased in Q2. By volume, the number of deals in Q2 was 6% greater than Q1. The average deal value was also high during Q2 at almost US$670 million, and compared to Q1, was 20% higher. Over the past few years, deal value for this sector has been steadily increasing. The average deal value in 2016 is 25% higher than the average for the past three years.

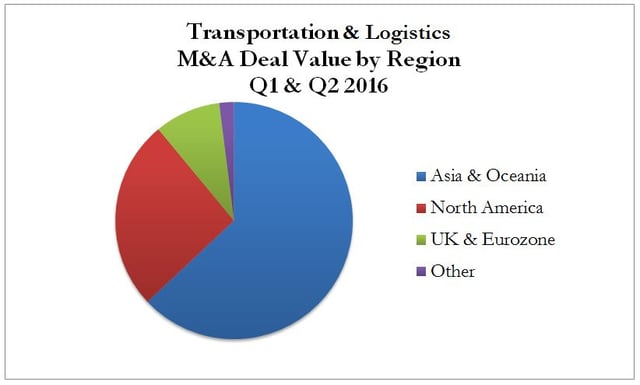

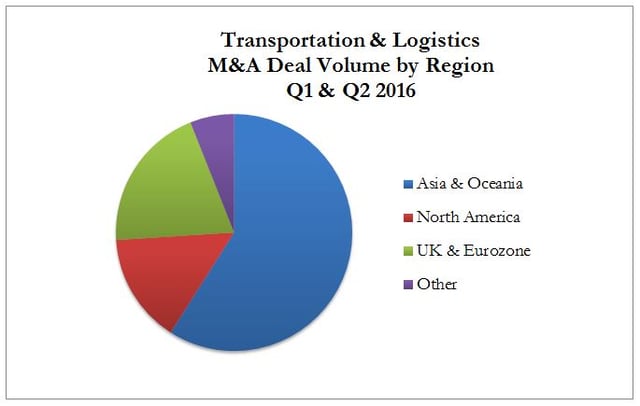

A major factor in the consistent increase in T&L activity is the current high level of M&A activity in Asia, in general, an in China, in particular. Asia has been a leader in this sector for deals over the past few years. As seen in the charts below, for the first half of 2016, Asia maintained a strong lead over other regions, in both deal value and volume, accounting for more than 50% of both measures. Additionally, in terms of both volume and value, financial buyers lag far behind strategic buyers in completing T&L mergers and acquisitions. Many of the companies within the T&L sector are looking to diversify across sub-sectors, which has also caused an increase in M&A demand from industry buyers.

During the first half of 2016, there were five mega deals completed in transportation and logistics, which totaled US$26.7 billion. The largest deal within the T&L sector was in the trucking sub-sector. Deal value in trucking increased 69% in Q2 2016, as compared to the same quarter in the previous year. In Q2 2016, Logistics was the second largest sub-sector, followed by shipping, with deal values of US$5.8 billion and US$923 million, respectively. Overall, the largest transaction during the first half of 2016 was Maanshan Dingtai Rare Earth & New Materials Co.’s acquisition of SF Holding Co. for US$16.8 billion.

Worldwide, mergers and acquisitions in the transportation and logistics sector is expected to continue growing. Corporations are currently seeking to outsource logistics that are heavily based in advanced technology. The expansion of world trade and e-commerce will continue to drive this demand. All in all, global M&A activity in the transportation and logistics sector should remain strong for at least the next five years and many are confident the activity will continue to grow across all sub-sectors. T&L merger and acquisitions activity in the US is also expected to increase.

Versailles Group is a 30-year-old Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For additional information, please contact

Founder and President

+617-449-3325

September 23, 2016