Middle market transactions are sometimes the most difficult to complete for several reasons. Many times, either the buyer or seller doesn’t have any experience in completing M&A transactions. This isn’t necessarily bad; however, they sometimes find the process confusing or frustrating. Therefore, it’s important to ask the following five questions before engaging a middle market investment bank to work on your transaction:

Who will work on the transaction?

Many middle market investment banks delegate important transactions to junior staff. Therefore, it’s important to make sure that the senior level bankers will take an active role in your transaction.

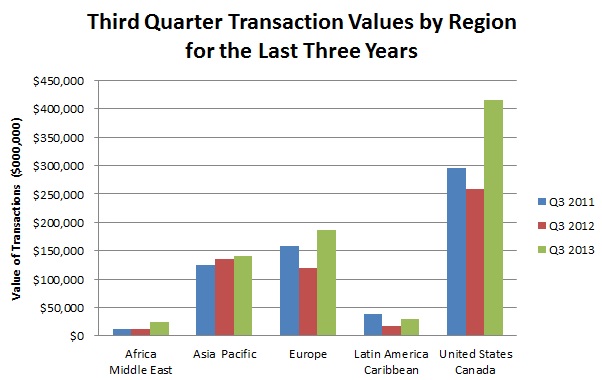

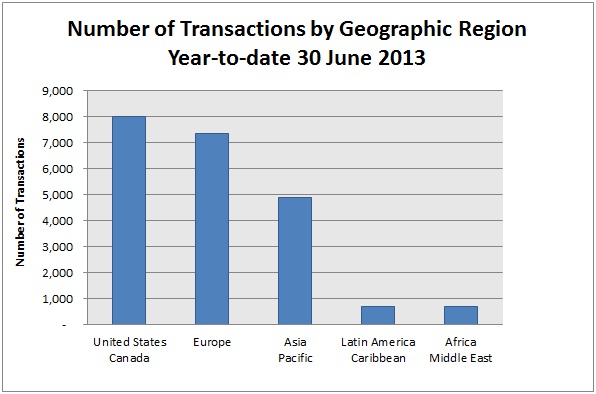

What is the “reach” of the middle market investment bank, both domestic and international?

Does the middle market investment bank have the ability to identify and contact buyers or sellers around the world? The world has gotten smaller and there are many opportunities in countries that were previously overlooked by the traditional investment bankers. That’s one of the reasons why many of the “old-line” firms are no longer in business.

What is the firm’s philosophy in terms of finding the right target or buyer?

Is the firm capable of thinking outside the box to identify unique buyers or sellers for your transaction? Too many firms have a myopic view of who the buyer or seller should be. The problem with that is that the client loses the potential to close a very lucrative transaction.

How long has the firm been in business and are they qualified?

It’s important to make sure that you’re dealing with a firm that has been in business for at least 10 to 20 years to make sure that they are capable of completing your transaction. There have been plenty of cases where the firm’s principals have jumped to a larger company and abandoned their clients. Also, is the firm registered, either directly or directly with FINRA (Financial Industry Regulatory Authority), the self-regulatory organization that oversees the industry? If the firm is registered, the principals will also be registered, which means that they have completed at least two qualifying exams, which are administered by FINRA.

Is the middle market investment bank capable of completing cross border transactions?

Given how the world has shrunk, cross border transaction capabilities are imperative. Opportunities are no longer confined to one’s home country and most of the time, the best deals are with companies on the other side of the world. Therefore, it’s important that your middle market investment bank have experience with international transactions. It’s easy to determine if they have this capability by checking out their tombstones.

In conclusion, it’s important to have a firm with well-experienced staff, credentials, experience, and longevity to make sure that your all-important transaction is completed successfully and in a reasonable time period.