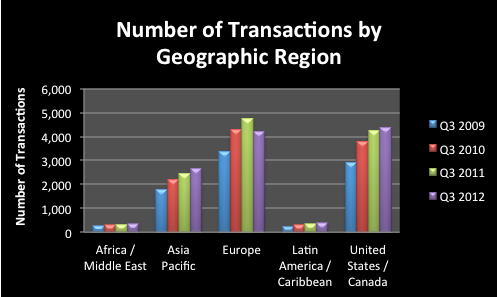

The most notable M&A news in Q3 was that there were more transactions in the United States/Canada region than there were in Europe. This is unusual, but we fully expect it to continue in the coming quarters as there seems to be limited progress in the resolution of the economic issues in Europe.

In Q3 the total number of M&A transactions in the United States/Canada increased by 137 to 4,372, which represented a 3% increase year-over-year. The Africa/Middle East, Asia Pacific, and Latin America/Caribbean regions all saw larger percentage increases during the same time period, 4%, 9%, and 9%, respectively. The only region that experienced a decrease in Q3 was Europe, where M&A activity dropped by 12% to 4,220.

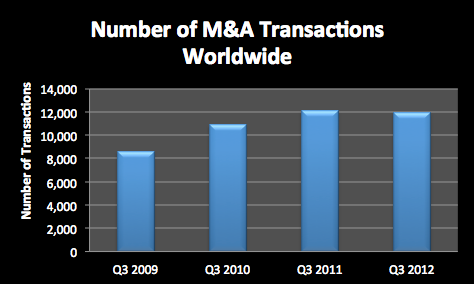

The net result of all of these changes was that the combined number of transactions worldwide fell by 1% year-over-year, from 12,146 to 11,993.

Historically, Q4 is the busiest quarter for M&A. Therefore, we are expecting a strong fourth quarter in most regions.

The most notable M&A news in Q3 was the significant increase in transactions occurring in the United States/Canada region compared to Europe. This shift is quite unexpected, but it appears to be a trend that will persist in the upcoming quarters due to the ongoing economic challenges faced by European countries. The divergence in M&A activity between these two regions reflects a broader narrative of economic uncertainty and market dynamics that are influencing global investment trends.

Versailles Group is a Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.