What exactly is an LOI, and how does it play a crucial role in M&A transactions?

KEY HIGHLIGHTS

Definition

A letter of intent (“LOI”) is a written expression, usually from buyers, that documents the buyer’s proposed price and terms including transaction structure, timeline, due diligence, confidentiality, exclusivity, etc. In many cases, the LOI is the first document negotiated between the buyer and seller.

Common Misconceptions

The LOI is the most misunderstood document by first-time sellers. Many think that it is a contract between the buyer and the seller. The LOI is a document that signifies acceptance and interest, similar to nodding your head. In other words, the LOI documents the intentions of the buyer and seller to complete a transaction. Sellers should be aware that there might be tricks hidden within the LOI like misleading language and concealed contingencies that require the expertise of both an M&A advisor and an attorney to identify and provide guidance on.

Binding vs. Non-Binding Nature

Typically, this document is non-binding and most LOIs clearly state that it is non-binding. Rarely, an LOI will contain a provision stating it's binding; however, it might be difficult to enforce a binding LOI as the nature of this document is non-binding. While the LOI is non-binding, all LOIs contain certain provisions that are binding, e.g., confidentiality, exclusivity, expenses, jurisdiction, etc. These binding provisions must be followed and, if not could result in the deterioration of the transaction and possible legal action if they are not.

Key LOI Provisions Sellers Should Scrutinize

| LOI Section | What It Covers |

|---|---|

| Purchase Price | Total consideration (cash, stock, earn-outs, debt) |

| Transaction Type | Stock vs. asset sale, assumed liabilities, allocation |

| Exclusivity | Buyer’s request for sole negotiating rights |

| Conditions to Close | Financing, due diligence, regulatory approvals |

| Post-Closing Obligations | Seller’s role after deal (consulting, transition) |

| Indemnification | Seller's liability for breaches after closing |

| Confidentiality | Protects sensitive info and workforce |

| Deposits | Good faith payments by buyer |

| Timeline | Target signing and closing dates |

| Advisory Review | Legal and financial counsel involvement |

When a buyer is interested in purchasing a business, a typical first step is for a buyer to make an offer for the business via an LOI. Upon receipt of an LOI, a seller will consult their M&A advisor, attorney, and possibly other professionals to develop a response strategy. Most of the time, the seller will respond, via their M&A advisor, with a counteroffer which leads to the negotiation of the LOI’s terms by the buyer and seller. After negotiations are concluded and both parties settle on agreed terms, the next step is for the seller and buyer to execute the LOI.

The signed LOI documents the buyer’s proposed purchase price and terms including transaction structure, timeline, due diligence, confidentiality, exclusivity, etc. Sometimes, the LOI is also called a Memorandum of Understanding (“MOU”), Indication of Interest (“IOI”), or a Term Sheet. Once the LOI is signed, due diligence begins, during which the buyer confirms the condition of the business. Before signing the LOI, the seller should confirm the buyer’s ability to complete the deal. This would involve the seller ensuring the buyer has the funds or capability to raise the funds to complete the purchase.

One of the challenges that the LOI presents for a seller is the buyer’s valuation of the business. Some buyers include an outsize valuation to entice the seller to accept. Once the buyer “locks up” the deal and the transaction progresses, they then will lean on complicated language in the LOI or use excuses like unreasonable working capital provisions to negotiate the valuation down. In other cases, the buyer will mention unsaid assumptions about performance expectations, etc. to lower the valuation. The price agreed upon in the LOI will almost always be negotiated throughout the entire duration of the transaction, so the seller needs to be aware of the buyer's incentives and tactics to drive the valuation down. Most importantly, the seller should rely on their trusted M&A advisor to help them achieve the purchase price they deserve for their business.

When reviewing an LOI, sellers should always ask their M&A advisors about a buyer’s reputation and ability to complete the transaction. An experienced M&A advisor has the knowledge and tools to be able to evaluate if the buyer is capable of completing the transaction at the agreed-upon value and if they will be fair in the negotiations.

Although LOIs establish expectations between buyers and sellers regarding the proposed transaction, they are non-binding documents. The terms may change during the due diligence phase as the buyer uncovers additional details about the selling company. It is therefore important not to confuse an LOI with a definitive purchase agreement, which is the binding contract signed only after due diligence is complete and both parties have agreed on all terms and conditions.

At Versailles Group, we often see sellers mistakenly view LOIs as binding agreements. To be clear, they are not. An LOI serves as a framework for negotiations, not a final contract. For a transaction to be successfully completed, both sides must remain mindful of the need for fair and reasonable negotiations throughout the process.

That said, any changes to the agreed-upon terms should be justified. During due diligence, the buyer will carefully verify and validate the seller’s information. Because the LOI leaves room for flexibility, negotiations may arise around certain issues—but with the right guidance, these discussions help keep the transaction moving toward closing. An experienced M&A advisor plays a critical role in this stage by facilitating the diligence process, reassuring buyers when appropriate, and negotiating any proposed revisions to the LOI’s terms.

While most of the terms in an LOI are non-binding, this important document may also contain some legally binding provisions, such as exclusivity, confidentiality, etc. It is worth noting that the terms of the LOI are subject to any confidentiality agreement previously entered into by the parties. If there is no prior agreement on confidentiality, the LOI may include confidentiality provisions such that any information shared between the parties will be held in confidence and not disclosed. In other cases, the LOI will contain stricter confidentiality provisions to protect the seller while disclosing much more data during the due diligence phase.

Exclusivity is one of the common binding terms in an LOI and is always demanded by buyers. The exclusivity provision prevents the seller from negotiating or seeking offers from other potential buyers during a specified period. This provision protects the buyer from losing the acquisition to another buyer during the due diligence phase. The buyer wants to have the protection that exclusivity grants as they will need to invest a significant amount of time and money into the diligence phase. The exclusivity period is a crucial term and often determines the timeline for the due diligence process and negotiation of agreements. However, the parties can agree to extend the exclusivity period if needed. M&A advisors know when and how to extend the exclusivity provision.

Signing the LOI with an exclusivity period takes the company off the market, which means the seller should be sure to do due diligence on the buyer’s financial ability before signing. The deal will not close if the buyer cannot pay the purchase price. Thus, it can sometimes be advantageous to accept a lower price from a financially capable buyer as opposed to a higher price from a potentially financially unstable buyer. An M&A advisor will provide guidance and expertise in evaluating the risks and benefits of different buyers’ reputations, transaction timelines, and purchase prices. Thus, allowing the seller can be confident in their decision to engage with a specific buyer.

For buyers and sellers, the initial presentation of an LOI and subsequent negotiations is akin to a “dance” between the two parties. This dance is a give-and-take between the buyer and seller and can be challenging due to the length of the exclusivity period. For buyers, the challenge is handling sellers who might play hard to get by offering a very brief exclusivity period because they have other suitors lined up. The buyer will contemplate if it is worth rushing through the due diligence phase and spending hundreds of thousands of dollars to avoid losing the potential acquisition.

On the other hand, a buyer who casually issues an LOI but then asks for a lengthy 120-day or longer exclusivity period could scare sellers away. Sellers must be aware that a lengthy due diligence period means the company is off the market for a long time. This can be problematic for the seller because if the buyer withdraws after a lengthy due diligence phase, they may need to “relaunch” the company for sale as other potential buyers may have already moved on. Simultaneously, sellers are not keen on exceedingly long due diligence processes as they do not have a clear commitment from the buyer as the LOI is not binding. In these circumstances, an experienced M&A advisor will be able to navigate these complex challenges to mitigate risk and achieve an optimal outcome.

The exclusivity provision plays a significant role in understanding the LOI paradox. Both parties are expected to have trust in each other, guided solely by the brief outlines of the agreement presented in the LOI. Trust between the parties can be difficult to establish at first and will develop over time. The shared experiences of working through the due diligence period and continued negotiation of the terms of the LOI emphasize the delicate balance required as both parties navigate toward a closing.

After negotiating the terms of the LOI with the assistance of an M&A advisor, it is critical to thoroughly review the LOI with an attorney before signing. The seller should also get advice from their CPA as to the financial structure to mitigate the tax impact. After the execution of the LOI, the sellers need to continue to seek advice and rely on their M&A advisor throughout the whole process. Most importantly, sellers should be careful not to focus only on the proposed sales price as many factors affect how good or bad the deal is for the seller.

In summary, a well-structured LOI protects sellers, preserves leverage, and sets the stage for a successful transaction.

Written by Xueying (Gil) He

Originally published: 13 March 2024.

Last updated: 21 August 2025.

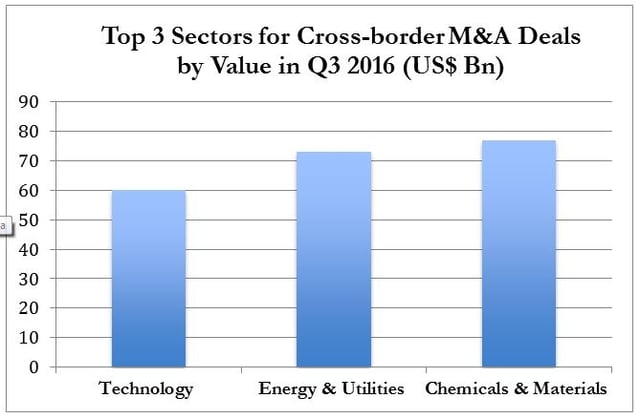

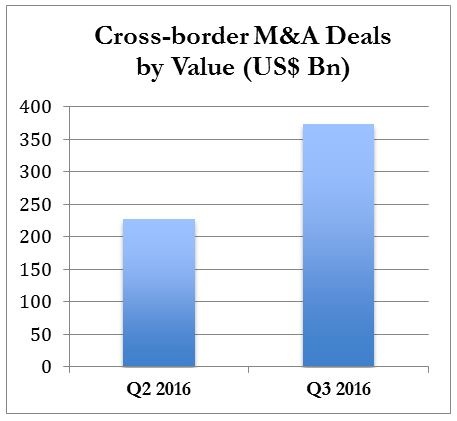

Versailles Group is a 37-year-old boutique investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues greater than US$2 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For additional information, please contact

Founder and President - Versailles Group, Ltd.

+617-449-3325