Record October for M&A Deals

Reflects Current Market Conditions

The US M&A market is on a roll, which is good news for both sellers and buyers in the middle market.

A series of high-profile deals announced in October makes it the biggest month ever for M&A transactions and even surpassed the epic deal making surge in January 2000. Mega deals are driving activity and are almost too numerous to count, e.g., the oil-and-gas business combination of General Electric and Baker Hughes, the telecom tie-up of Century Link and Level 3, and AT&T’s acquisition of Time Warner, etc.

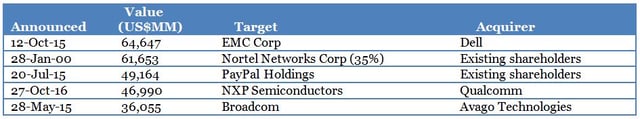

Another good example in the global semiconductor sector is Qualcomm’s US$47 Billion acquisition of NXP Semiconductors, which notched the biggest semiconductor targeted M&A deal on record globally.

Top 5 Global Tech Targeted M&A Deals on Record

So far this year, US$1.6 Trillion of M&A transactions has been announced in the domestic market. It reflects easy financing conditions, more confidence in the economic and business outlook, and keen foresight on the part of management teams.

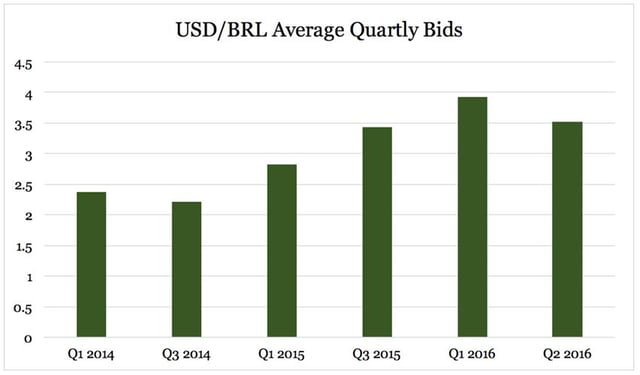

The current economic environment of low interest rates and high stock prices have encouraged deal making. Cheap borrowing costs makes it easy to finance deals, while high stock prices provide companies with higher valuations.

With unprecedented economic conditions, owners of middle market businesses, in particular, have a continued incentive to start or keep doing deals.

Versailles Group is a 30-year-old Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues greater than US$2 million. Versailles Group has closed transactions in all economic environments, literally around the world.

Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987.

More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For additional information, please contact

Founder and President

+617-449-3325

November 15, 2016