Importance of Due Diligence

Importance of Due Diligence

Due diligence is a critical part of any deal. However, this is not just a time for the buyer to research the seller. It is equally important that the seller research the buyer. If a deal falls through because of problems with the buyer performing, e.g., a lack of funding, the seller will have wasted both time and money.

Typically, due diligence is performed after a Letter of Intent (“LOI”) has been executed by both buyer and seller. This process usually takes 30-60 days or sometimes longer if there are complicating factors. This is a time for the buyer to ensure that the company they are buying meets the standards the seller claims it does, i.e., that it matches what is stated in the selling memorandum and subsequent management meeting(s). If the information does not match, the buyer may negotiate a lower price, attach extra conditions to the sale, or pull out altogether.

It is in the seller’s best interest to ensure that due diligence is completed as soon as possible. Delays extend the transaction and could ruin the deal entirely. Therefore, it is important to answer promptly any information requests from the buyer. It is usually helpful to give the buyer access to the company’s CPA firm and attorney. Most of the time, the selling company’s information is loaded into a virtual data room for the buyer’s review. Sensitive documents should be coded so that they can only be reviewed, not copied or printed. The most organized sellers set up the virtual data room before executing the LOI to save time.

Any negative information about the company should obviously not be emphasized. At the same time, it shouldn’t be hidden. The seller always makes a mistake when they assume the buyer won’t discover some weakness. That’s the classical mistake of underestimating your opponent. The seller should always assume that the buyer will discover this information during due diligence and will wonder what else the seller is hiding. That usually slows the transaction down and results in the buyer increasing the size of the escrow or adding onerous terms to the Definitive Agreement. Even if the information remains hidden, it will likely come out after closing, and that will cause the buyer to withhold payment of the escrow or other deferred payments based on the grounds that the business was misrepresented. Instead, the seller should be upfront with any problems the company has and should indicate potential solutions. A well-qualified financial advisor will know how to present this type of information. Let’s face it, 10Ks and many other documents contain negative information that is presented in such a way that it’s not enough of a problem to dissuade someone from investing. This is the same issue.

To avoid wasting time and before executing a LOI, it is the seller’s responsibility to make sure that the buyer has the financial wherewithal to purchase their business. Additionally, the seller should ensure that the buyer will be able to run the business once they have purchased it. If there are red flags, the seller should adjust the payment structure accordingly to make sure they are getting the best deal possible. Both the buyer and the seller need to do their due diligence to make sure the transaction closes on or close to the scheduled timing. That way, both buyer and seller achieve success, which is the ultimate goal.

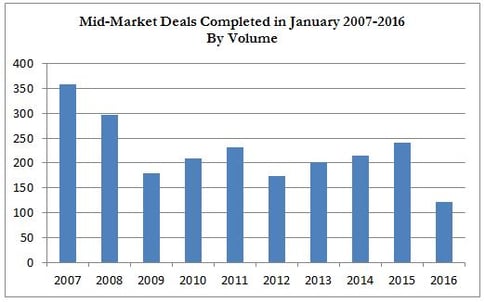

Versailles Group is a 29-year-old Boston-based investment bank that specializes in international mergers, acquisitions, and divestitures. Versailles Group’s skill, flexibility, and experience have enabled it to successfully close M&A transactions for companies with revenues between US$2 million and US$250 million. Versailles Group has closed transactions in all economic environments, literally around the world. Versailles Group provides clients with both buy-side and sell-side M&A services, and has been completing cross-border transactions since its founding in 1987. More information on Versailles Group, Ltd. can be found at www.versaillesgroup.com.

For more information, please contact

Donald Grava

Founder and President

617-449-3325

March 7, 2016